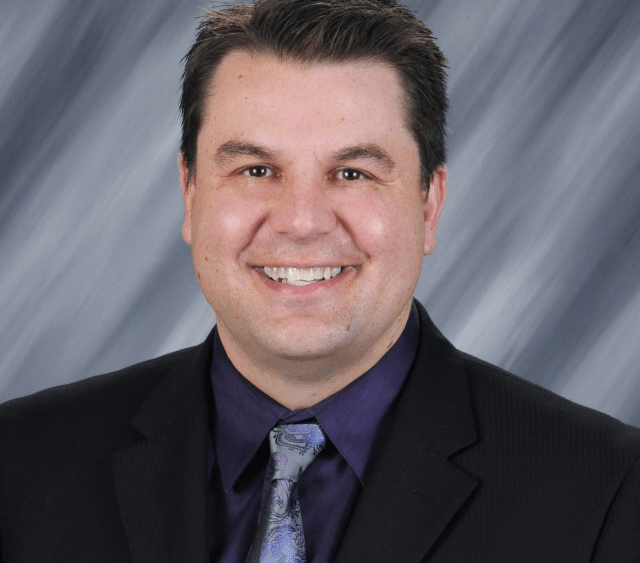

Iowa farmland owners may not realize just how much history goes into determining their property taxes. Brent Johnson, president of the Iowa Farm Bureau Federation, explained on a recent Iowa Business Report podcast with Jeff Stein how a decades-old formula shapes agricultural tax policy in the state.

“Property tax — it is a pretty complicated topic, but ultimately many decades ago we put together a productivity formula to make sure that agriculture land is taxed at an appropriate level for the productivity that it provides the area.”

Johnson said the formula that is in place continues to ensure farmland is taxed fairly. He noted that as Iowa lawmakers balance the pros and cons to changes in property tax policy, any changes should preserve the connection to funding local services.

“…property taxes for property services so making sure that we’re funding those things that are closely connected to property so world roads and infrastructure and in things like that so just to make sure that we have that proper representation of the tax that’s intended to be collected to make sure that we’ve got those proper places in sync with the proper taxation point.”

The Iowa Business Report covers business, agriculture, and policy issues across the state. More information is available at iowafarmbureau.com.